Start an LLC in North Carolina

To start your LLC in North Carolina, you will need to choose a name for your business, designate a registered agent, and file Articles of Organization with the North Carolina Secretary of State ($125 filing fee). You can use our Step-by-Step Guide below to form your business yourself and get next steps, like securing an EIN, opening a bank account, and paying ongoing fees.

Or, skip the stress of piecing it all together – we can set you up with your LLC and all the essential tools immediately so you can focus on building your business, not paperwork and compliance hassles.

What you get when we set up your North Carolina LLC:

- Full LLC formation

- Registered agent service

- State fees covered

- Business domain

- Pre-built and secure website, business email, and local business phone number

Our one-time fee of $277 covers your LLC formation, registered agent service (which will renew for $49 annually), and state fees; giving you the most affordable and comprehensive package in the state. No extra upfront costs, and you can cancel anytime.

Why Choose Our NC LLC Formation Service?

Starting an LLC is just the beginning. While most filing services stop at basic formation and paperwork, we go above and beyond. We equip you with the tools, resources, and ongoing support needed to run and grow your business–all while ensuring your privacy is protected.

Here’s exactly how we’re different:

- Start & maintain your LLC all in one place: Form your LLC with us and gain instant access to a personalized account dashboard. Stay organized with helpful reminders, track compliance deadlines, and manage everything in one convenient place.

- Privacy protection: Use our registered agent address instead of your home address on public records.

- Straightforward & transparent pricing: No hidden fees or upsells for things you don’t need.

- Registered Agent Service INCLUDED: We can serve as your designated registered agent (a registered agent is required to form an LLC in North Carolina). Use our address and we will scan and upload your state and legal mail so you never miss a notice.

- Essential Business Tools We offer all the necessary tools you need to not just start your business, but to grow it too. Like a pre-built website, domain, business email, local business phone number, and more! Enjoy all of these tools when you form your LLC with us.

⭐⭐⭐⭐⭐

21 reviews | 3,000+ businesses formed

“Tara went above and beyond for me today, she helped me fully understand what a registered agent can bring to the table for my business. She gave me very detailed information, and even went an extra step by emailing me links and step by step instructions. 5 stars for Tara!”

– Jay C.

“…They make it so easy – if you have a question, the response time is amazing. They actually email you a response. If you get stuck on something, they direct you in the right direction. What would take 4 weeks to complete, they completed in 72 hours. Hands down, worth every cent for their professionalism, their customer service and the peace of mind that’s provided.”

– Mary S.

Our Guarantee: no hidden fees, cancel anytime, transparent pricing, privacy protection, and real human support.

Our #1 goal is to make business easy.

How to start an LLC in North Carolina: A Step-by-Step Guide

1. Choose a name for your North Carolina LLC

In choosing your NC business’s name, you must meet the following state requirements. According to statute § 55D-20:

- The name must be distinguishable upon the records of the Secretary of State from the name of any other entity on the business registry

- The name cannot contain any offensive words or phrases

- The name should not contain any language stating or implying that the entity is organized for any purpose other than a purpose that is lawful and permitted by its formation documents

- The name must contain the words “limited liability company”, or the abbreviation “L.L.C.” , “LLC” or the combination “Ltd. Liability Co.”, “Limited Liability Co.”, or Ltd. Liability Company”.

2. Get a NC Registered Agent

North Carolina requires that you designate a registered agent for your LLC. A registered agent is an individual (18 years or older) or company that must be present during regular business hours at a physical address within the state to receive legal and official mail for your LLC.

If you decide to be your own registered agent, your name and personal or business address will become part of the LLC’s permanent public record. Choosing a registered agent service can help you maintain greater privacy.

3. File the Articles of Organization

You must file Articles of Organization with the North Carolina Secretary of State to officially create your LLC. The North Carolina filing fee is $125 + $3 credit card processing fee. If you’re ready to begin, you can use our online form here.

Use our free tool to start filling out your Articles of Organization.

We’ll save your progress, so feel free to take your time. When you’re ready to create your LLC, you can hire us and we’ll file for you or you can submit the forms yourself.

Once you file the Articles of Organization and they are processed, your LLC is officially formed. The next steps to take are:

4. Get an Employer Identification Number (EIN)

If you plan to hire employees, have more than one owner, or would like to choose how the IRS treats your LLC for taxes, you will need to get an Employer Identification Number (EIN) through the IRS.

5. Write an LLC Operating Agreement

An Operating Agreement is a contract between the owners of an LLC that explains how the business is run, how decisions are made, and how ownership is handled. In North Carolina, it isn’t required, but the law gives LLCs the option to create one. Even though it’s optional, having an Operating Agreement is highly recommended because it provides important clarity and protection for your LLC. Until an agreement is in place, state law sets the rules for how the LLC operates.

6. Open a business bank account

Strengthen your North Carolina LLC’s liability protection by keeping your personal and business finances separate. This also makes it easier to manage payments and keep your financial records organized.

What are the benefits of an LLC in NC?

The benefits of an LLC in North Carolina are protection and flexibility.

- Protection: An LLC creates a clear separation between your personal assets and your business assets, keeping your personal finances safe if something goes wrong.

- Management options: You get to decide who runs your business, how it’s structured, and how ownership is divided.

- Tax options: You can choose the tax structure that works best for your business, including:

- Claiming business taxes on your personal tax return to avoid corporate taxes

- Filing your LLC as a corporation or an S-corp if it benefits your business

So how does starting a corporation differ from starting an LLC? A North Carolina Corporation also offers liability protection, but it can face potential double taxation and have stricter requirements when it comes to management, ownership, and record keeping structure.

Bottom line: Forming an LLC gives you the freedom to run your business your way, with a lot more opportunity for flexibility.

How our North Carolina LLC Formation Works:

✅ You order our North Carolina LLC Formation Package

✅ Within 24 hours, our expert filers prepare and submit your North Carolina Articles of Organization

✅ Within 8 business days, we send you confirmation that your North Carolina LLC has been formed by the North Carolina Secretary of State

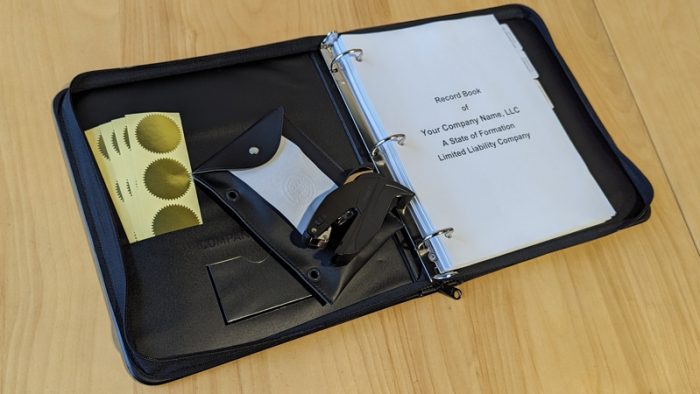

✅ We send your customized LLC documents to you

✅ We provide North Carolina Registered Agent Service for 1 full year & send you a renewal for the next year

Transparent Pricing: Here’s Where Your Money Goes

| Services | Fee |

| North Carolina state filing fee | $125 + $3 credit card processing fee |

| Our full LLC formation service fee | $100 |

| One year of NC Registered Agent Service | $49 |

| Total | $277 |

FAQs

How do I form an LLC in North Carolina?

There are 6 steps to form an LLC in North Carolina.

1. Choose a name for your LLC

2. Get a North Carolina Registered Agent

3. File the Articles of Organization

4. Get an Employer Identification Number (EIN)

5. Write an LLC Operating Agreement

6. Open a business bank account

Do I need a registered agent in North Carolina?

Yes, your LLC must have a registered agent with a physical address in North Carolina. When you hire us to form your LLC, you can automatically list us as your registered agent at our local address provided.

Do I need an operating agreement for my LLC in North Carolina?

While an operating agreement is not required by law in NC, it is a good idea to have one. An operating agreement is the guidebook for how you’ll run your company and can help avoid disputes down the road.

How much does it cost to start an LLC in North Carolina?

The state filing fee is $125 plus a $3 processing fee ($128 total) if you’d like to go through the filing process yourself. Skip the stress of filing and compliance hassles and hire us to form your LLC for $277 with registered agent services included.

More Frequently Asked Questions

How do I get an EIN for my LLC?

You can apply for an employer identification number (EIN) on the IRS website. You will need an EIN if your LLC has more than one owner, hires employees, or if you choose to change how the IRS treats your LLC for taxes (if you’d like to elect to be taxed like an S-Corp or a C-Corp). The easiest way to get your EIN is to add it at checkout when you’re registering your LLC with us. That way, you’ll receive your EIN at the same time as your LLC, making the process smoother and faster.

What are the annual filing requirements?

If you have an LLC in North Carolina, you must file an annual report with the NC Secretary of State by April 15th every year. If you miss the deadline, you will be at risk of fees or your LLC being shut down.

Do LLCs pay taxes in North Carolina?

LLCs in North Carolina are treated as pass-through entities by default. This means the income is reported on the owners’ personal tax returns. However, LLCs can also elect to be taxed as corporations.

What types of LLCs can I form in North Carolina?

In North Carolina, you can form several types of LLCs, including single-member LLCs, multi-member LLCs, and professional LLCs.

Should I open a bank account for my North Carolina LLC?

Yes, opening a separate bank account for your North Carolina LLC is highly recommended to keep your business finances separate from personal ones and maintain liability protection.

Can I form a North Carolina LLC if I live outside of North Carolina?

Yes, you can form a North Carolina LLC even if you don’t live within the state. But, you will need a registered agent with a physical address in North Carolina like us!

Does an LLC need a business license in North Carolina?

Some LLCs in North Carolina require a business license depending on the industry and location. It’s important to check with your local city or county office.

What is the North Carolina Annual Report?

The North Carolina annual report is a yearly filing that LLCs must submit to maintain good standing with the state. It includes basic information about your business and is required by law.

Can North Carolina Registered Agent file my North Carolina LLC annual report?

Yes, we can file your LLCs annual report on your behalf to keep you compliant without the hassle.